December 3, 2018

As of December 1, 2018 Mexico has a new

President.

President Andres Manuel López Obrador

will be President of Mexico for the next

6 years. There are still many questions

about the programs he will develop and

promote, but he stated in his inaugural

address that starting January 1, 2019

the minimum wage will double, the IVA

(Value Added Tax) in the border zone

will be lowered to 8% from 16%, and

income tax will be lowered to 20%.

A major reform to the Federal Labor Law

is currently being discussed in Congress

and we have 4 new Health and Safety

Standards that will be published soon.

The

NOM-035-STPS-2018, Occupational

psychosocial risk factors –

Identification, analysis and prevention

was published October 23, 2018

(available in English) and the new

ergonomic standard for manual loading

and unloading, “NOM-036-1-STPS-2018,

was published November 23, 2018.

UPDATE YOUR RISK ASSESSMENTS WITH THE

NEW REQUIREMENTS

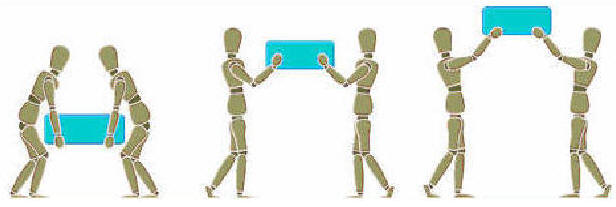

The new Ergonomic Standard “NOM-036-1-STPS-2018,

Occupational ergonomic risk factors

-Identification, analysis, prevention

and control. Part 1: Manual load

handling” was published

in the DOF on November 23, 2018 and will

take effect January 4, 2020

This new standard will be available in

translation this week and available to

the Deluxe Package subscribers and the

Health and Safety Package subscribers.

This standard is designed for analyzing

the risk from manual loading and

provides a process and guide for risk

assessment. The standard takes effect

January 4, 2020 so that companies will

have time to develop training for manual

loading and to update risk studies for

each job position with the ergonomic

risk from manual loading and unloading.

By January, 2020 Companies should

develop and provide the following:

• Training

• Updated risk assessments

• Monitoring of workers’ health

• Units of Verification

The standard contains a formula for

choosing a random selection of employees

to review and the procedure for risk

assessment from manual loading and

unloading. Companies can do their own

training based on the standard or hire

3rd parties. If you hire 3rd party

trainers, you must make sure they have

certification from the STPS as

instructors or the training will not be

considered as valid.

We are developing training for this

standard; you can request a quotation to

provide this training. We can prepare

your

RISK ASSESSMENTS or train and

assist you to update them.

TAKE ADVANTAGE OF THESE GOVERNMENT

PROGRAMS

Many of you have been asking me for

information on Government programs that

you might be able to take advantage. I

have spent some time researching the

following programs that can mean big

savings if you can take advantage.

SAVINGS FUND – FONDO DE AHORRO

One way that companies can increase

compensation without increasing the

income tax or Social Security is through

a Savings Fund (Fondo de Ahorro). The

Savings Fund is a very important savings

mechanism. Basically, it consists of a

savings program of a determined amount

of money retained from the worker’s pay

and matched equally by the employer. The

worker can only withdraw this amount

once a year.

The matching payments made by the

Employer are deductible expenses for the

company and exempt from income tax or

Social Security. The following

requirements apply:

The amounts cannot be greater than 13%

of the worker’s wages (when they are

larger they are subject to income tax.

The Employer must match the amount

retained from the worker’s wages.

Here is an example:

Objectives of the Savings Fund

These are some of the objectives of

the Savings Fund:

Estas son algunas de las

características y objetivos de los

fondos de ahorro:

• Promote the habit of saving by the

workers and improve their living

standard

• The Fund is exempt from Social

Security and is not integrated into

the Salary for Social Security

purposes.

• As long as the amounts contributed

do no pass the limit of 10 times the

minimum wage with the 13% payment,

it will be exempt from income tax,

if it exceeds the amount it is 100%

taxable.

According to the Income Tax Law (Ley

de Impuesto sobre la Renta) –

Article 29, section VII and Article

31 section XII of the law state that

the Savings Fund is a social welfare

expense for the company and becomes

a deductible expense, provided it

complies with the law.

• It must be available to all the

workers of the company – the same

for Administrative personnel as well

as general laborers.

• A written plan is required.

Remember the fund can be withdrawn

only:

• At the end of the labor relation

• One time per year

PROGRAM FOR A FISCAL INCENTIVE –

REDUCTION OF THE STATE PAYROLL TAX

The following program is a Baja

California state program and allows

companies that are expanding to apply

for a discount or exemption for from up

to 5 years of the State payroll tax. The

program is applicable to companies that

are expanding and adding new jobs.

There is an application form that awards

points for:

• the number of employees (direct and

indirect),

• the salary levels,

• the amount of the investment,

• investment in technology,

• employee benefits (food service,

public or private transport, childcare

• clean technology

• renewable energy sources

Based on the number of points obtained,

a company will be given a certificate

from SEDECO that will discount the

payroll tax for the amount and time

period in the certificate.

CITATION: “Law for the

Promotion of competitiveness and

economic development for the State of

Baja California” (Ley de Fomento a la

Competitividad y Desarrollo Económico

para el Estado de Baja California) and

its Regulation of the Law for the

Promotion of competitiveness and

economic development for the State of

Baja California (Reglamento de la Ley de

Fomento a la Competitividad y Desarrollo

Económico para el Estado de Baja

California)

APPLICABLE TO:

• Start up Companies

• Companies with an expansion project

• Companies with water treatment and

reuse system

BENEFITS:

• 1 – 5 years of 25 to 100 percent

discount of the State Payroll tax

• 20 to 50% for water connections and

sewer fees

• 30% discount on monthly water bill

REQUIREMENTS FOR AN EXPANSION PROJECT:

• Application letter

• Payroll tax exemption request

• Business plan

• Acta Constitutiva of the company

(Incorporation document)

• Letter with identification of the

legal representative

• Las payroll tax payment

STATE

GOVERNMENT DEPT. THAT IS RESPONSIBLE

**•

SEDECO – Secretary of Economic

Development

FEDERAL HEALTH AND SAFETY CERTIFICATION

PROGRAM – (AUTO GESTIÓN)

CITATION: Federal Labor Law,

Regulation for Occupational Health and

Safety, Social Security Law

APPLICABLE TO: All companies

BENEFITS: Companies with

certification will be granted a discount

on the Risk Rate (Prima de Riesgo) for

Social Security. Social Security sets a

risk rate factor for a company based on

accidents and their industrial

classification. The rate for most new

companies is around 7%, that means 7%

cost on top of your payroll. With low

accidents a company can lower this rate

by 1% per year to the lowest rate of

.005. Many companies see a reduction by

up to 4% off the monthly cost of Social

Security.

A company that has certified their

Health and Safety program through the

Federal Auto-Gestión program have their

risk rate calculated on a lower base

rate and it can mean a substantial

reduction in Social Security payments

for all workers. Certification is

achieved by verifying compliance to all

applicable health and safety standards

by means of a series of audits from

Federal inspectors. Companies that

enroll in the program will be inspected

but will be exempt from fines. Once they

are certified, they will not be

inspected for 3 years and will not be

subject to fines.

REQUIREMENTS: Requires the

company to have a compliant health and

safety program.

FEDERAL GOVERNMENT DEPT. THAT IS

RESPONSIBLE: STPS – Secretary

of Labor and Social Welfare.

If you would like more information

or would like help in taking

advantage of these programs, please

contact me.

Lic. Glenn Louis McBride

Mexican Attorney

Mexican cell. (011-521) 664-204-1257

US cell 1-619-513-0556

Office tel. (011-52) 664-681-9524

www.mexicanlaws.com